The IRS 1040-SR Form Role in the Tax System

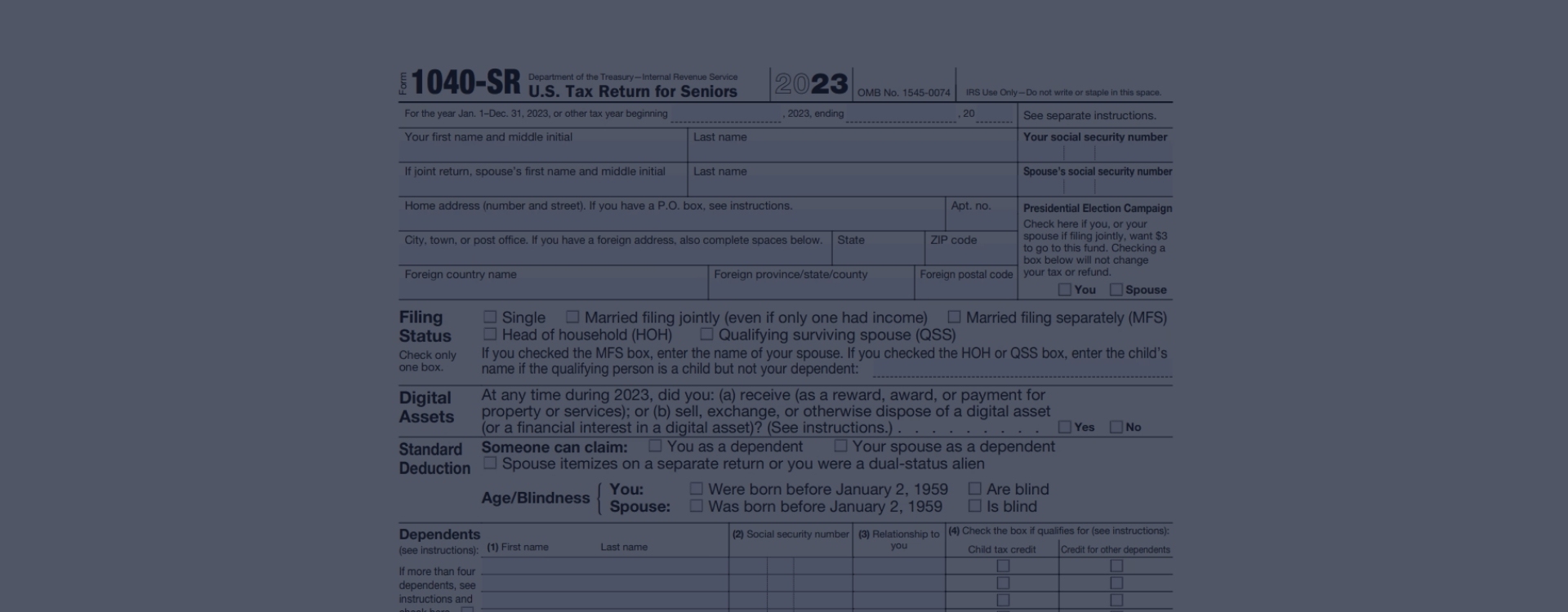

IRS Form 1040-SR is a version of the tax return tailored specifically for senior taxpayers aged 65 and older. It was introduced as an easier option for seniors, offering a clearer, more readable font size and a simplified income reporting process. Essentially, Form 1040-SR mirrors the standard 1040 return but includes a chart for the taxpayer’s standard deduction and a more senior-friendly design. The primary purpose of the printable Form 1040-SR for 2023 is to make the tax filing process more accessible and straightforward for older taxpayers, whether they have complex retirement income streams or just basic sources.

Our Website Advantages

Turning to the valuable resources offered by printable-1040sr-form.com, these materials greatly assist seniors in navigating the complexities of tax returns. With a printable blank 1040SR form available, seniors can obtain a physical copy to review and prepare their taxes offline at their own pace. Additionally, the website provides comprehensive instructions and helpful examples to guide users through each section of the 1040-SR tax return for seniors. This aids in ensuring accuracy and completeness when reporting income, deductions, and credits unique to their financial situation. Not only does the site ensure that seniors have access to a copy of the 2023 1040-SR at their fingertips, but it also offers the ease and security of having all the necessary information in one place to manage their fiscal obligations confidently.

Terms for the 1040-SR Tax Return Filing

IRS Form 1040-SR offers a simplified, easier-to-read format with larger print and a standard deduction chart that could provide added benefits based on age and filing status. This printable IRS tax form 1040-SR is designed to accommodate the typical sources of income for seniors, such as Social Security, pensions, and retirement distributions, while still allowing for the reporting of additional earnings.

Take, for instance, Martha Simmons, a 68-year-old retiree who must fill out the 1040-SR form. After dedicating over 35 years to her teaching career, Martha now enjoys a comfortable retirement based on the steady income she receives from her pension and Social Security benefits. Her financial situation also includes interest from savings accounts and investment dividends, all of which necessitate a clear and accurate tax filing. Form 1040-SR is well-suited for Martha, as it simplifies the reporting process for her various income streams and allows for an easier understanding of potential deductions and credits.

On the other hand, we have James Torres, a 72-year-old freelance consultant who remains partially active in his field. Because James earns income from consulting services, in addition to his retirement accounts and Social Security benefits, he needs to report his various sources of earnings accurately. James opts to print IRS Form 1040-SR, finding it to be a better fit as it was designed with his demographic in mind, simplifying the tax filing process. The form's clarity and larger typeface make it easier for him to navigate his taxes without overlooking any potential deductions connected to his consulting work or retirement income.

Peculiar Properties of Tax Form 1040-SR

-

![Simplicity]() SimplicityThe 1040-SR form by Interntal Revenue Service offers a more straightforward layout tailored for seniors, with larger print and a clearer display of standard deductions, making tax filing less daunting.

SimplicityThe 1040-SR form by Interntal Revenue Service offers a more straightforward layout tailored for seniors, with larger print and a clearer display of standard deductions, making tax filing less daunting. -

![Age-Friendly]() Age-FriendlyDesigned explicitly for taxpayers 65 and older, the 1040SR printable form ensures that seniors can conveniently access and utilize a tax document that caters to their typical financial situations, such as Social Security benefits and retirement income.

Age-FriendlyDesigned explicitly for taxpayers 65 and older, the 1040SR printable form ensures that seniors can conveniently access and utilize a tax document that caters to their typical financial situations, such as Social Security benefits and retirement income. -

![Standard Deductions]() Standard DeductionsHighlighting increased standard deduction amounts directly on the form, the 1040-SR makes it easier for older taxpayers to identify their eligibility without consulting additional tax schedules or documents.

Standard DeductionsHighlighting increased standard deduction amounts directly on the form, the 1040-SR makes it easier for older taxpayers to identify their eligibility without consulting additional tax schedules or documents.

Blank Form 1040-SR for Print

Get FormSteps to Fill Out the 1040-SR Printable Form in 2024

Navigating the complexities of tax forms can often feel daunting, but if you're a senior taxpayer, the IRS printable 1040-SR form is designed to meet your needs. This guide will ensure you can fill out the blank template correctly and efficiently. Before you begin, ensure you have all relevant documentation, such as W-2 forms, 1099s, and records of any deductions or credits you plan to claim.

- To begin, head to our website to download the IRS 1040-SR printable form in PDF. This version is tailored for those 65 and older, with a larger font size and a more readable layout.

- Once you have the copy, you can opt to fill it out online or print the 1040-SR form and complete it manually; both options are available for your convenience.

- Start with your personal information. Enter your name, social security number, and address in the appropriate sections. Make sure to double-check the spelling and numbers to prevent any processing delays due to errors.

- The 1040-SR tax form instructions will guide you through the income section. Report your sources of income, including Social Security benefits, pensions, wages, or any other payments you've received. Reporting every source accurately is crucial to avoid penalties or an audit.

- Next, move to the "Adjusted Gross Income" section. Here, you'll deduct certain expenses, like student loan interest or contributions to a retirement account, to determine your adjusted gross income (AGI). Calculating your AGI correctly is vital as it affects your taxable income and potential deductions.

- Deductions come next. The 1040-SR form sample allows you to take either the standard deduction or itemized deductions. The standard deduction amount is higher for seniors, which could be beneficial unless your itemized deductions exceed that amount.

- After entering your deductions, calculate your fiscal liability with the help of tax tables or the IRS’s online calculator. If you've made any estimated tax payments or had withholdings from pensions or Social Security, you'll account for these in the payments section.

- Upon reaching the refund or amount owed section, determine if you'll receive a refund or if you need to make a payment. To avoid mistakes, recheck your math and confirm that all numbers have been transferred correctly.

- Finally, sign and date the IRS Form 1040-SR printable for 2023 at the bottom. If you're filing jointly, ensure both spouses sign. Remember, an unsigned tax return is like an unsigned check – it’s invalid.

File Form 1040-SR on Time

Taxpayers are required to file the federal income tax form 1040-SR by April 15th of every year. The deadline is extended to the next business day if the due date falls on a weekend or a legal holiday.

Get FormWhen you miss this deadline, the IRS may impose penalties, which include a failure-to-file fee. This fee is typically 5% of the unpaid taxes for each month or part of a late tax return. Ensuring that all information on your tax forms is accurate is crucial. Submitting false information can lead to severe consequences, such as fines and criminal prosecution. To avoid these penalties, ensure accurate reporting and timeliness when you choose to file the 1040-SR form online.

IRS Tax Form 1040-SR: Frequently Asked Questions

- Who is eligible to use the IRS Form 1040-SR for tax filing?It is specifically designed for senior taxpayers who are aged 65 or older by the end of the tax year. It offers a simpler and more readable format and a standard deduction chart that can accommodate the needs of older taxpayers.

- How is the IRS 1040-SR tax form printable different from the regular 1040?While both forms are used to file an individual tax return, the 1040-SR is tailored for seniors, with a focus on ease of readability, and includes a chart for the standard deduction that varies based on age and filing status. It also highlights certain income types that are more common for seniors, but it otherwise functions similarly to the regular Form 1040.

- Can I file Form 1040-SR electronically, or do I need to mail it in?You can choose to e-file Form 1040-SR just as you would with the standard 1040. Electronic filing is often quicker and can lead to faster processing of your return. For those who prefer paper filing, mailing is still an option.

- What should I do if I need help understanding the printable 1040-SR tax form instructions?If the instructions for the printable 1040-SR tax form seem complex, consider seeking assistance from an advisor or use the IRS's Interactive Tax Assistant. The IRS website also provides instructions and publications that can be very helpful in understanding how to fill out the form correctly.

- Is there an example of a completed IRS Form 1040-SR that I can refer to?Certainly, you can find an IRS Form 1040-SR example on our website. This example can guide you through the process of filling out your own copy, ensuring that you understand the proper way to report your income and deductions.

- How do I obtain a copy of the form to start my tax filing?To download the 1040-SR form, simply visit our website and click the "Get Form" button. This will provide you with a free printable tax form 1040SR that you can use to prepare your tax-related filing without any cost. Remember to verify that you are downloading the correct form for the tax year you are filing.

Form 1040-SR for Seniors: More Instructions

Form 1040-SR for 2023 The United States tax system has seen numerous forms designed to address the various needs of taxpayers. One such example is the IRS tax form 1040SR for 2023, which was introduced as part of the Bipartisan Budget Act of 2018. This form emerged to simplify the filing process for senior taxpayers, all...

Form 1040-SR for 2023 The United States tax system has seen numerous forms designed to address the various needs of taxpayers. One such example is the IRS tax form 1040SR for 2023, which was introduced as part of the Bipartisan Budget Act of 2018. This form emerged to simplify the filing process for senior taxpayers, all... - 24 January, 2024

- Form 1040-SR Instructions One of the critical tools provided for taxpayers, particularly for those who are aged 65 and over, is the IRS Form 1040-SR. It's a tax form designed to make the process of filing taxes simpler and more accessible. Essentially, the 1040-SR tax form instructions are meant to provide a clear guide on h...

- 23 January, 2024

- 1040SR Fillable Tax Form Are you a senior seeking clarity on your annual tax filing obligations? Form 1040-SR, often referred to as the U.S. Tax Return for Seniors, is tailored specifically for taxpayers aged 65 and older. It serves as an alternative to the standard Form 1040 and provides a larger, easier-to-read font size...

- 22 January, 2024

Please Note

This website (printable-1040sr-form.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.