Form 1040-SR for 2023

- 24 January 2024

The United States tax system has seen numerous forms designed to address the various needs of taxpayers. One such example is the IRS tax form 1040SR for 2023, which was introduced as part of the Bipartisan Budget Act of 2018. This form emerged to simplify the filing process for senior taxpayers, allowing a more straightforward way to prepare their annual tax returns. Prior to this, all taxpayers had to use the 1040 or 1040EZ, which could be more complex and less tailored to the unique circumstances of seniors.

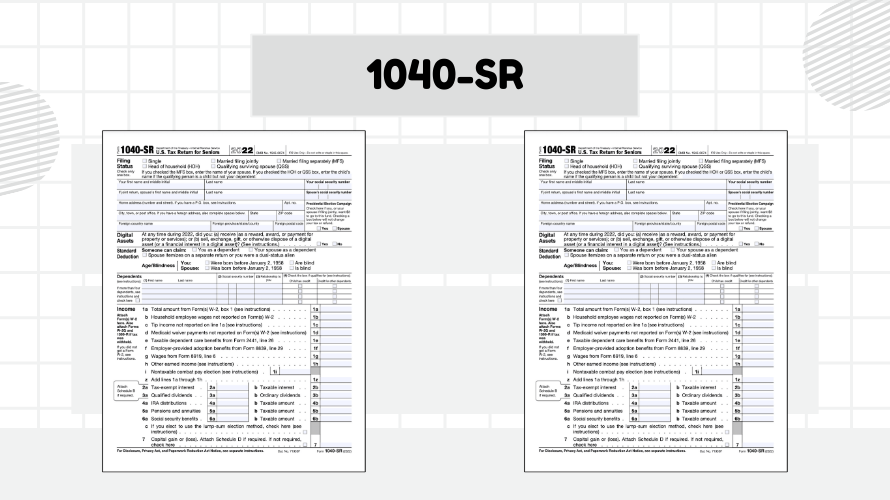

Adjustments to the 1040-SR Income Tax Form

Every year, the Internal Revenue Service reviews and updates tax documents to ensure they meet the current federal tax-related laws and taxpayers’ needs. The blank Form 1040-SR for 2023 has been modified to reflect such changes including standard deduction amounts, thresholds for certain credits, and any new legislation affecting reporting requirements for seniors. Additionally, the form has been designed to have a larger font and a more readable layout, making it more user-friendly for older taxpayers.

Eligibility Criteria for Using Form 1040-SR

Form 1040-SR is tailored for seniors and specifically designed for taxpayers aged 65 or older by the end of the fiscal year. However, there are no income restrictions or limitations on the types of income that can be reported on this statement. Despite the target demographic, it's essential to understand who cannot use this document. If taxpayers are below the age of 65, they are generally required to use the standard Form 1040. Also, nonresident aliens may not use Form 1040-SR and must use the 1040-NR copy instead.

Leveraging Form 1040-SR for Optimal Benefits

To make the most of the printable 1040SR tax form for 2023, here are a few tips to ensure seniors can maximize their benefits effectively:

- Standard Deduction Charts

Pay attention to the standard deduction chart provided on the 1040-SR income tax form for 2023, which may be more advantageous for seniors compared to other filers. - Healthcare Costs

Keep meticulous records of healthcare expenses since many seniors qualify for medical expense deductions that are not as accessible to other age groups. - Charitable Contributions

Remember that taxpayers using Form 1040-SR can take advantage of tax benefits associated with charitable contributions even if they don't itemize deductions. - Free Tax Assistance

Seniors can utilize available programs like the IRS's Tax Counseling for the Elderly (TCE) program, which provides free help, specifically for Form 1040-SR filers. - Filing Electronically

Even though you can access and print the copy online, consider electronic filing, which could result in a faster refund and may help avoid potential errors.

When you're ready to fill out Form 1040-SR for 2023, make sure to review all instructions thoroughly, check for the latest tax-related updates that might affect your federal annual return, and consult with a financial professional if you have any doubts. It's important to take advantage of every benefit available to you to potentially lower your tax burden while ensuring compliance with the IRS rules and regulations.