1040SR Fillable Tax Form

- 22 January 2024

Are you a senior seeking clarity on your annual tax filing obligations? Form 1040-SR, often referred to as the U.S. Tax Return for Seniors, is tailored specifically for taxpayers aged 65 and older. It serves as an alternative to the standard Form 1040 and provides a larger, easier-to-read font size and a simplified income reporting format geared towards the common types of income for seniors. This form simplifies tax filing, ensuring seniors can report their retirement income, social security benefits, and other investments with ease.

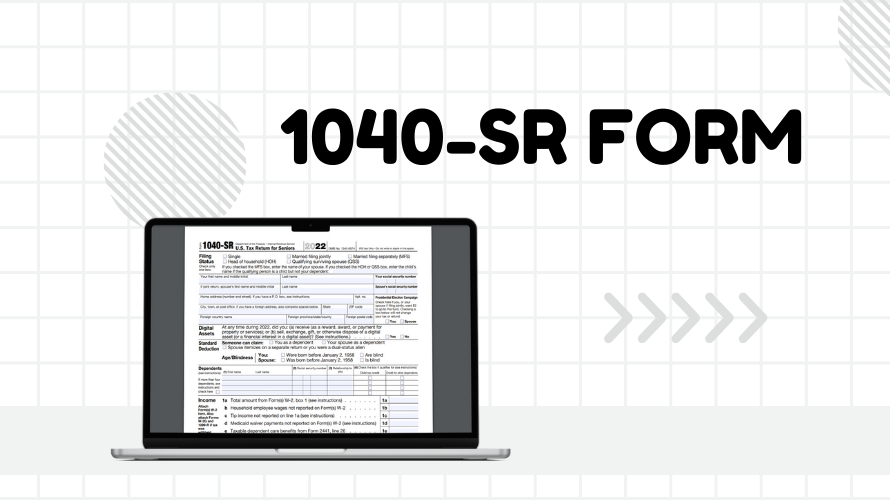

Features of the Fillable 1040-SR Form

Embracing the digital age, the IRS provides a free fillable Form 1040-SR, which is designed to facilitate a more streamlined and accurate tax filing process. Through this IRS fillable Form 1040SR, you can enter your information directly into the document using your computer or tablet. The digital framework not only keeps your records safe but also automatically checks for basic errors and performs necessary calculations, thus minimizing the potential for mistakes.

Filing 1040-SR Online Form Without Hurdles

Filing taxes online is convenient, but it may come with challenges. For starters, navigating an online interface may be daunting for some users. Additionally, ensuring the security of your personal and financial information is paramount when submitting the 1040-SR online fillable form. Users may also encounter difficulties with their web browsers or have trouble saving and retrieving their partially completed forms. Ensuring a stable internet connection and using an updated browser can mitigate most technical hiccups.

Completing the Fillable Form 1040-SR with Accuracy

- Gather All Relevant Documents

Before you start filling out the federal form 1040-SR fillable, make sure to collect all necessary financial statements, such as SSA-1099 for Social Security benefits, 1099-R forms for pensions and IRAs, and other pertinent income-related documentation. - Double-Check Your Information

Carefully review each entry for accuracy. Simple errors related to Social Security numbers, account figures, or misspelled names can lead to processing delays or incorrect tax calculations. - Know Your Deductions and Credits

Senior taxpayers often qualify for specific deductions and credits. Research or consult with a tax professional to understand what you're eligible for. - Electronic Signatures

With the 1040SR fillable tax form, you can sign electronically using a secure self-select PIN method, which provides extra convenience and security. - Seek Help If Needed

If you’re uncertain about any steps in the process or need personalized guidance, do not hesitate to seek the help of a tax professional or use the IRS's interactive tax assistance online.

Filing your taxes doesn't have to be complicated, even in the digital era. By leveraging the advantages of the 1040-SR fillable tax form online, you can achieve a hassle-free submission from the comfort of your own home. Remember to start early, thoroughly verify your entries, and keep abreast of any changes in tax laws that may affect your returns. A careful approach will pave the way for a successful tax filing experience.